Bitcoin and Gold : The Rising Stars in an Approaching Recession

As we edge closer to a potential recession, the prices of Bitcoin and gold are seeing notable increases. These two assets, while fundamentally different, are often viewed as safe havens during times of economic uncertainty. We saw this clearly in 2020 when job losses and economic fears drove up both Bitcoin and gold prices significantly. Their rising prices can be attributed to several key factors: institutional investors taking stake in gold ETF as well as Bitcoin, scarcity of both assets in the market.

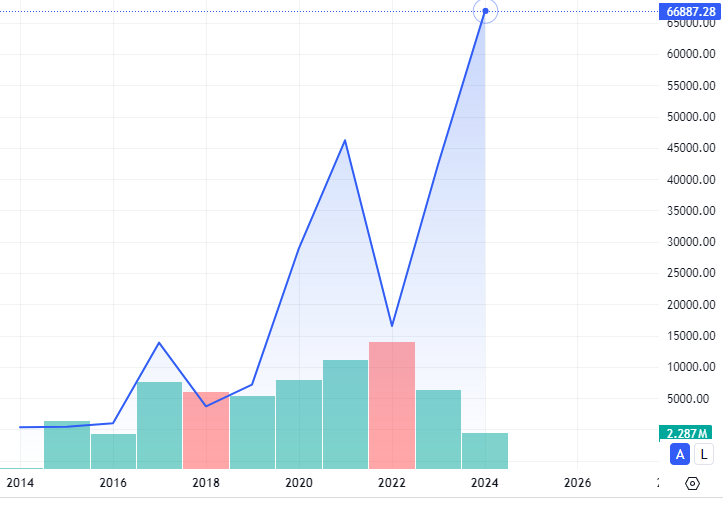

Bitcoin, often dubbed "digital gold," has captured significant attention as a store of value. Unlike fiat currencies, which can be devalued through inflationary policies,as no authority controls bitcoin, people's belief in blockchain technology makes it valuable. Bitcoin’s supply is capped at 21 million. This scarcity, combined with its decentralized nature, makes it an appealing option for those seeking to preserve their wealth during periods of economic turmoil.

As central banks worldwide respond to economic slowdowns with measures like quantitative easing and low interest rates, the risk of inflation escalates. Bitcoin, with its fixed supply, is seen as a hedge against inflation. Investors flock to Bitcoin to safeguard their purchasing power, driving up its price.

In recent years, Bitcoin has seen increasing adoption by institutional investors. Companies such as Tesla, MicroStrategy, and Square have made substantial investments in Bitcoin, signaling a growing acceptance of the cryptocurrency as a legitimate asset class. This institutional interest not only boosts Bitcoin’s price but also provides a sense of legitimacy and stability, attracting more investors during uncertain economic times.

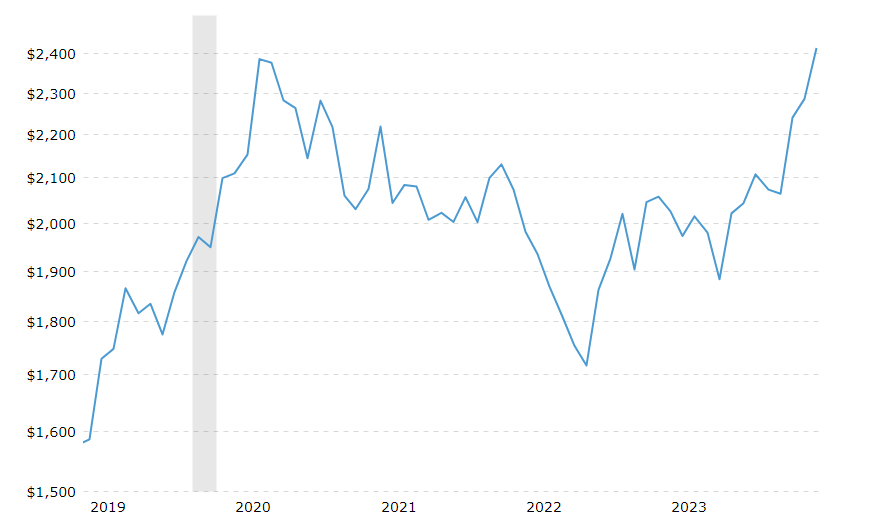

Gold has been a store of value for thousands of years, outlasting many forms of currency and economic systems. Its historical significance as a safe haven asset makes it a go-to for investors during times of economic uncertainty. When the economy is shaky, investors turn to gold as a reliable means of preserving their wealth.

Gold’s value tends to rise during periods of economic instability. When stock markets crash and currencies depreciate, gold often retains its value or even appreciates. This characteristic makes gold a popular choice for investors seeking to mitigate risk during recessions.

One of the key reasons investors flock to gold during economic downturns is its low correlation with other asset classes. While stocks and bonds may suffer during a recession, gold often moves independently of these assets. This low correlation provides a diversification benefit, helping to reduce the overall risk of an investment portfolio.

Comparing Bitcoin and Gold

While both Bitcoin and gold are seen as safe havens, they have distinct characteristics that appeal to different types of investors.

Gold’s physical nature makes it appealing to those who prefer tangible assets. Its physical properties are valued for industrial use, jewelry, and as a form of currency. Conversely, Bitcoin’s digital nature appeals to tech-savvy investors and those who believe in the potential of blockchain technology. Bitcoin’s portability and ease of transfer across borders are significant advantages over gold.

Bitcoin is notoriously more volatile than gold. While this volatility can lead to significant gains, it also carries a higher risk of substantial losses. Gold, in contrast, tends to be more stable, providing a safer, albeit slower, appreciation in value. This difference in volatility attracts different types of investors: those with a higher risk tolerance may prefer Bitcoin, while more conservative investors might lean towards gold.

Bitcoin offers greater accessibility compared to gold. It can be bought and sold easily online, with transactions occurring 24/7. Gold, while also traded electronically, often requires physical storage, adding to its overall cost and complexity. This ease of access makes Bitcoin an attractive option for a global audience.

The actions of central banks and governments in response to economic slowdowns play a crucial role in the rise of Bitcoin and gold prices. Low interest rates, quantitative easing, and large fiscal stimulus packages can lead to currency devaluation and inflation. Investors, seeking to protect their wealth, turn to Bitcoin and gold as hedges against these economic policies.

Geopolitical tensions, trade wars, and the ongoing effects of the COVID-19 pandemic contribute to global economic uncertainty. These factors can lead to market volatility and diminished confidence in traditional financial systems. In such an environment, assets like Bitcoin and gold become more attractive as they are perceived to be more resilient to such shocks.

Investor sentiment shifts significantly during times of economic uncertainty. The fear of losing money in traditional assets like stocks and bonds drives investors to seek out safer alternatives. The psychological aspect of investing cannot be understated, as fear and uncertainty can lead to increased demand for perceived safe havens like Bitcoin and gold.

Conclusion

As the threat of a recession looms, the prices of Bitcoin and gold continue to rise. Both assets offer unique advantages as stores of value and hedges against economic instability. Bitcoin, with its fixed supply, technological appeal, and growing institutional adoption, provides a modern alternative to traditional financial systems. Gold, with its historical significance, stability, and low correlation with other assets, remains a trusted safe haven during economic downturns.

The broader financial environment, marked by inflationary pressures, central bank policies, and global economic uncertainty, further drives the demand for these assets. As investors seek to protect their wealth and diversify their portfolios, the allure of Bitcoin and gold is likely to persist, keeping their prices elevated as we navigate the uncertain economic landscape ahead.

Prices of Gold source : Microtrends

Prices of Gold source : Microtrends